Primary Market

Set up Subscription and Redemption for your token

Primary market

Open ended instruments

This guide will enter in the details of how to manage the primary market for your tokenised open ended instruments.

Subscriptions

T-REX Engine allows you to create subscriptions for your open ended instrument. It is very flexible and lets you give a number of details to be the closest to what you what you would have achieved with a traditional asset subscription.

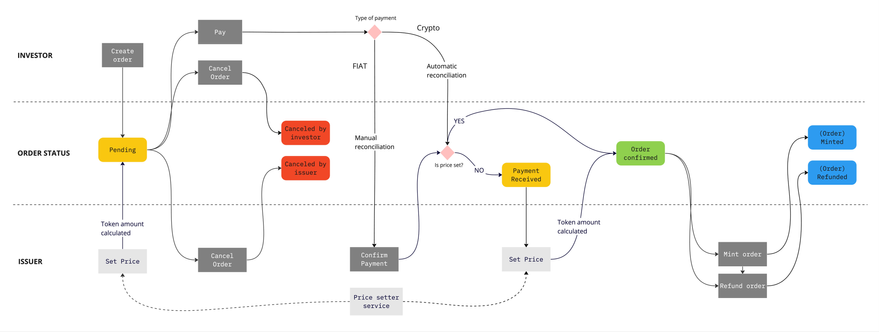

Below is a breakdown of the flow of the subscription, including statuses for the order, on both the issuer and investor sides:

Lexical considerations

From this point forward, keep in mind the following definitions:

- Subscription: The blueprint of the subscription offers that will be made by an investor. In this context, "creating a subscription" is not the same thing as "making a subscription offer", but means "setting up the rules for subscribing in my asset". For example: base currency, distributor connection, cut-off...

- Subscription interval: Define the rules of the subscription for a given period of time: caps, fees...

- Subscription order: An order that an investor made to subscribe in your token.

Create the subscription

Setting up a subscription means:

- Define a meaningful name for your investors

- Define the base currency for the price of the subscription

- Open the subscription to 3rd party distributors

- Define the minting strategy: before or after payment confirmation

- Define the supported currencies for the subscription: which can be both fiat or crypto-currencies

- For each of those currencies, you will also define the payment method: for fiat, the bank account receiving the wire transfer, for cryptocurrencies, the wallet that will receive the tokens.

- For cryptocurrency payments, the T-REX Engine will automatically validate the payment by scanning the blockchain. For fiat payments, manual reconciliation is needed.

- The subscription strategy: by investment amount or by token quantity

- Warning and information text to be displayed to the investor (not mandatory)

- A link to a calendar to set up the cut-off and days-off for your investment

Once your subscription is set up, you need to manage your interval by linking it to your subscription and:

- Define a meaningful name for your investors

- Define the start and end dates of the interval

- Define the fees:

- Flat: a fixed fee in the currency of the subscription taken on all offers

- Percentage: a fixed percentage fee taken in the currency of the subscription

- Percentage on invested amount: a fixed percentage fee taken in the currency of the subscription offer

- Define the subscription caps, in the base currency of the subscription:

- Minimum subscription amount: the minimum investment

- Maximum cap: the maximum cap of the investment

- Maximum subscription amount: the maximum investment

- Define the price of the token: either fixed price or taken from NAV setting

- Define the minting strategy: automatic at the confirmation of the order or manual

You're now all set to open subscription on your tokens.

Manage orders

Once the subscription and the interval are set up, your investors will start creating subscription offers. All orders have a status to let you know where they stand in the subscription process, you can follow the flow on the state machine above.

When an order is created, it is in status PENDING. You can do the following actions in this status:

- Confirm payment: In case the payment is done in fiat currency, you have to manually reconcile the payment through the reference given to the investor during the subscription.

- Cancel an order: You can cancel an order on behalf of an investor, in case the need arises (support, errors...)

When the order is confirmed, you can do the following actions in this status:

- Mint order: mint in the provided investor wallet the quantity of tokens subscripted to.

- Refund order: if in the end you decide to not go through with minting, you can refund the subscription.

Note: You will have to manually take care of the actual refund. This last action only updates the status of the order, it does not trigger the payment in any capacities.

Manage exchange rates

In case the payment is done in another currency as the base currency of the token for the subscription, you might need to manage exchange rates.

T-REX Engine allows three different methods of managing the exchange rates:

- Manual: You manually input, in the confirmation of the payment, the exchange rate you want to apply

- At creation: The exchange rate applied will be the one at the time of the creation of the order

- At payment: The exchange rate applied will be the one at the time of the payment of the order

Manage orders on behalf of an investor

In case you manage orders on another system and want to replicate onchain through the T-REX Engine, you can also manage orders on behalf on investors. You can:

- Create an order: You can act as an investor to create an order for the subscription. As for investors, it will be created in a

PENDINGstatus. - Cancel an order: As for the investor use case, you can cancel the order as long as it is in a

PENDINGstatus. - Confirm payment: In case the payment is done in fiat currency, you have to manually reconcile the payment through the reference given to the investor during the subscription.

Redemptions

T-REX Engine allows you to create redemptions for your open ended instrument. It is very flexible and lets you give a number of details to be the closest to what you what you would have achieved with a traditional asset subscription.

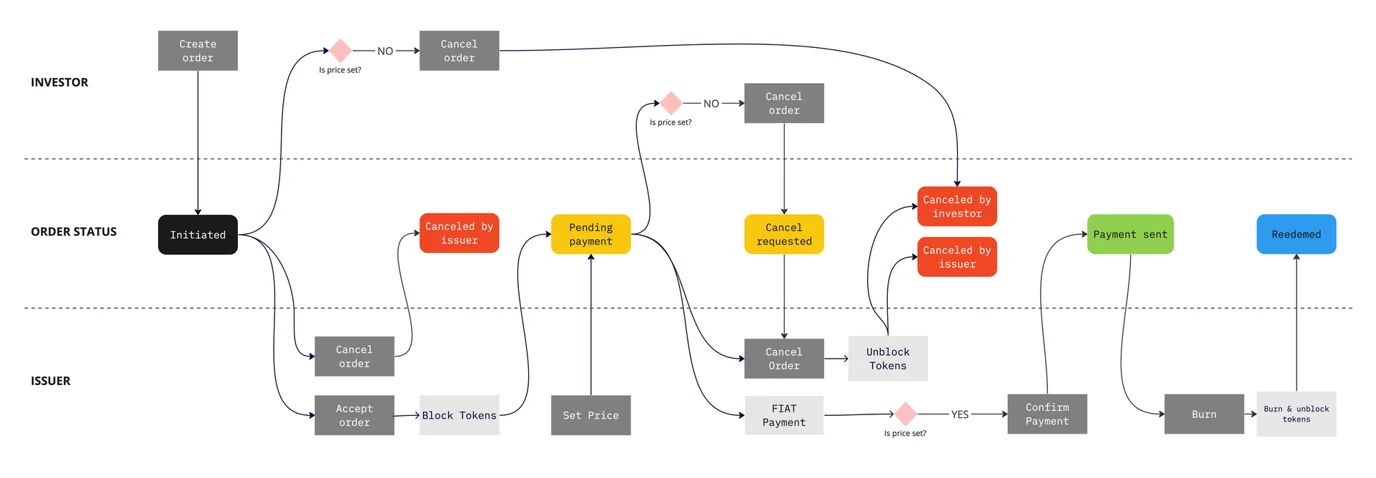

Below is a breakdown of the flow of the redemption, including statuses for the order, on both the issuer and investor sides:

Lexical considerations

From this point forward, keep in mind the following definitions:

- Redemption: The blueprint of the redemption offers that will be made by an investor. In this context, "creating a redemption" is not the same thing as "making a redemption offer", but means "setting up the rules for redeeming my asset". For example: base currency, distributor connection, cut-off...

- Redemption order: An order that an investor made to redeem your token.

Create the redemption

Setting up a redemption means:

- Define a meaningful name for your investors

- Define email templates for notifications

- Define the start and end dates of your redemption process

- Define the price setting strategy: either directly through the NAV of the asset or as a manual input

- In case of manual input, please define here the price of the token for the redemption

- Define the currencies supported for the payment of the redemption

- Define the cut-off and days-off strategy

- Burning strategy: either directly after the confirmation of the redemption order or manually.

- Set up information and warning text for your investors (not mandatory)

- Link it to an existing deployed token

Once those are set up, your investors are ready to redeem their tokens.

Manage orders

Once the redemption is set up, your investors will start creating redemption offers. All orders have a status to let you know where they stand in the redemption process, you can follow the flow on the state machine above.

When an order is created, it is in status INITIATED. You can do the following actions in this status:

- Accept order: If the redemption order is acceptable, you can approve it. This ends up in two actions:

- The blocking of tokens in the wallet of the investor. This requires to sign a blockchain transaction with an agent wallet.

- The change of the status to

PENDING PAYMENT.

- Cancel order

When the order is PENDING PAYMENT, you can do the following actions in this status:

- Confirm payment: confirm that the payment has been sent to the investor. The status is then updated to

PAYMENT SENT - Cancel order.

Note: You will have to manually take care of the redemption payment. This first action only updates the status of the order, it does not trigger the payment in any capacities.

In PAYMENT SENT status, the only action you can do is to burn the tokens representing the position of the investor. Depending on the set up of the redemption, this step can be automatically triggered by the Confirm payment action. After this step, the order is in status REDEEMED.

Manage orders on behalf of an investor

In case you manage orders on another system and want to replicate onchain through the T-REX Engine, you can also manage orders on behalf on investors. You can:

- Create an order: You can act as an investor to create an order for the subscription. As for investors, it will be created in a

PENDINGstatus. - Cancel an order: As for the investor use case, you can cancel the order as long as it is in a

PENDINGstatus. - Confirm payment: In case the payment is done in fiat currency, you have to manually reconcile the payment through the reference given to the investor during the subscription.

Close ended instruments

This guide will enter in the details of how to manage the primary market for your tokenised open ended instruments.

Subscriptions

T-REX Engine allows you to create subscriptions for your close ended instrument. It is very flexible and lets you give a number of details to be the closest to what you what you would have achieved with a traditional asset subscription.

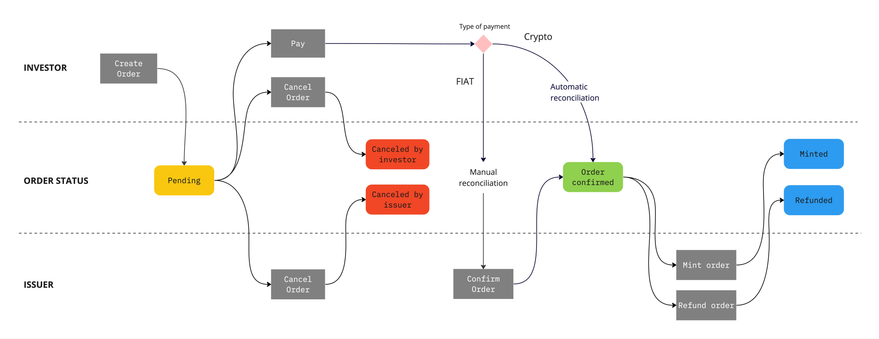

Below is a breakdown of the flow of the subscription, including statuses for the order, on both the issuer and investor sides:

Lexical considerations

From this point forward, keep in mind the following definitions:

- Subscription: The blueprint of the subscription offers that will be made by an investor. In this context, "creating a subscription" is not the same thing as "making a subscription offer", but means "setting up the rules for subscribing in my asset". For example: base currency, distributor connection, cut-off...

- Subscription interval: Define the rules of the subscription for a given period of time: caps, fees...

- Subscription order: An order that an investor made to subscribe in your token.

Create the subscription

Setting up a subscription means:

- Define a meaningful name for your investors

- Define the base currency for the price of the subscription

- Open the subscription to 3rd party distributors

- Define the minting strategy: before or after payment confirmation

- Define the supported currencies for the subscription: which can be both fiat or crypto-currencies

- For each of those currencies, you will also define the payment method: for fiat, the bank account receiving the wire transfer, for cryptocurrencies, the wallet that will receive the tokens.

- For cryptocurrency payments, the T-REX Engine will automatically validate the payment by scanning the blockchain. For fiat payments, manual reconciliation is needed.

- The subscription strategy: by investment amount or by token quantity

- Warning and information text to be displayed to the investor (not mandatory)

- A link to a calendar to set up the cut-off and days-off for your investment

Once your subscription is set up, you need to manage your interval by linking it to your subscription and:

- Define a meaningful name for your investors

- Define the start and end dates of the interval

- Define the fees:

- Flat: a fixed fee in the currency of the subscription taken on all offers

- Percentage: a fixed percentage fee taken in the currency of the subscription

- Percentage on invested amount: a fixed percentage fee taken in the currency of the subscription offer

- Define the subscription caps, in the base currency of the subscription:

- Minimum subscription amount: the minimum investment

- Maximum cap: the maximum cap of the investment

- Maximum subscription amount: the maximum investment

- Define the price of the token: either fixed price or taken from NAV setting

- Define the minting strategy: automatic at the confirmation of the order or manual

You're now all set to open subscription on your tokens.

Manage orders

Once the subscription and the interval are set up, your investors will start creating subscription offers. All orders have a status to let you know where they stand in the subscription process, you can follow the flow on the state machine above.

When an order is created, it is in status PENDING. You can do the following actions in this status:

- Confirm payment: In case the payment is done in fiat currency, you have to manually reconcile the payment through the reference given to the investor during the subscription.

- Cancel an order: You can cancel an order on behalf of an investor, in case the need arises (support, errors...)

When the order is confirmed, you can do the following actions in this status:

- Mint order: mint in the provided investor wallet the quantity of tokens subscripted to.

- Refund order: if in the end you decide to not go through with minting, you can refund the subscription.

Note: You will have to manually take care of the actual refund. This last action only updates the status of the order, it does not trigger the payment in any capacities.

Manage exchange rates

In case the payment is done in another currency as the base currency of the token for the subscription, you might need to manage exchange rates.

T-REX Engine allows three different methods of managing the exchange rates:

- Manual: You manually input, in the confirmation of the payment, the exchange rate you want to apply

- At creation: The exchange rate applied will be the one at the time of the creation of the order

- At payment: The exchange rate applied will be the one at the time of the payment of the order

Manage orders on behalf of an investor

In case you manage orders on another system and want to replicate onchain through the T-REX Engine, you can also manage orders on behalf on investors. You can:

- Create an order: You can act as an investor to create an order for the subscription. As for investors, it will be created in a

PENDINGstatus. - Cancel an order: As for the investor use case, you can cancel the order as long as it is in a

PENDINGstatus. - Confirm payment: In case the payment is done in fiat currency, you have to manually reconcile the payment through the reference given to the investor during the subscription.

Cash management

T-REX Engine can be configured to use case both onchain and offchain.

Offchain cash

As defined above, you can set up fiat currency to manage your subscription and redemptions. If you chose those method of payments, you will have to manually reconcile the payments between your own cash management system and the offers.

Onchain cash

If you define cryptocurrencies as a mean of payment for subscription, the T-REX Engine can automatically reconcile the payment by scanning the blockchain and identifying the transaction emitted from the wallet of the investor to the treasury wallet defined at subscription level. This allows for a more built-in end-to-end experience and necessitates less interaction from the agents.

Tokeny is looking to enhance this onchain cash management and is looking to expand these capabilities through different partnerships. Please check this page as more solutions will soon be available.

Updated 17 days ago